As an important payment instrument, the bill of exchange not only simplifies the payment process but also enhances the security and reliability of transactions.

Next, I will take you on an in – depth exploration of the definition, main content, common types, main characteristics of the bill of exchange, and matters needing attention during its use.

Essentially, a bill of exchange is a payment instrument that can substitute for cash and is widely used in domestic and international trade and capital settlement fields. In an international trade scenario, for example, a Chinese export enterprise sells goods to an American importer.

The Chinese export enterprise, as the drawer, issues a bill of exchange, entrusting the bank designated by the American importer (the drawee) to pay the payment to the Chinese export enterprise (the payee) at sight or on a specified date, thus completing the capital settlement of the cross – border transaction and avoiding many inconveniences and risks of direct cash transactions in cross – border circulation.

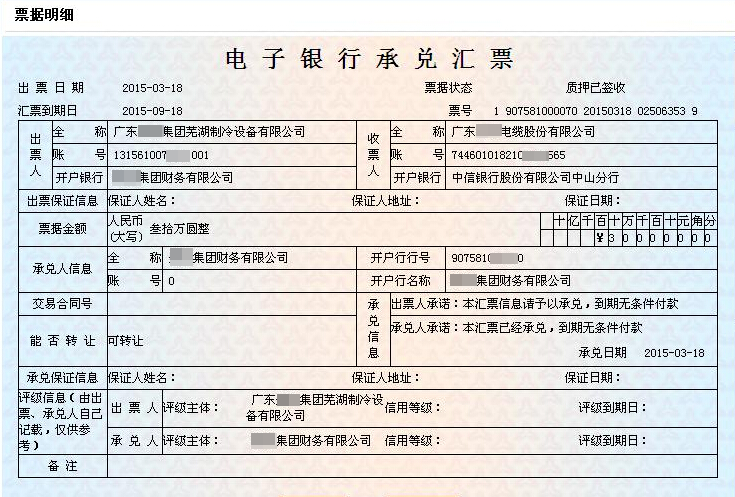

- The words “Bill of Exchange”: The words “Bill of Exchange” must be clearly marked on the instrument. This is a significant identifier that distinguishes it from other types of instruments, demonstrating its special nature and enabling all relevant parties to clearly identify the nature of the instrument at a glance.

- Unconditional order to pay: The drawer gives an unconditional instruction to the drawee to pay a specific amount. This means that the drawee must unreservedly fulfill the payment obligation under the conditions specified in the bill of exchange, without any additional conditions or restrictions, ensuring the certainty of the payee’s right to receive payment.

- Determined amount: The payment amount should be clearly stated on the instrument, and the amount in words and figures must be consistent. This is one of the core elements of the bill of exchange. The precise specification of the amount ensures the clarity of the transaction amount and avoids disputes caused by ambiguous amount expressions. In actual operation, if the amount in words and figures is inconsistent, according to the provisions of the negotiable instrument law, the bill of exchange is usually considered invalid. Therefore, the drawer must carefully check the writing of the amount.

- Name of the drawee: Clearly indicate the name of the drawee, that is, the entity that undertakes to pay the funds. As the bearer of the payment liability of the bill of exchange, the accurate indication of the drawee’s identity is of great significance, enabling the payee to know to whom the right to claim payment should be exercised.

- Name of the payee: Indicate the name of the payee, that is, the recipient of the funds. Accurate payee information ensures the accuracy of the capital flow and prevents mispayment or wrong payment of funds.

- Date and place of issue: Recording the date and place of issue of the instrument is of great significance. The date of issue helps to determine the validity period of the instrument. Different types of bills of exchange have different regulations on the limitation period. For example, a sight bill of exchange must be paid immediately at sight, while a time bill of exchange determines the payment time based on the date of issue and specific rules. The place of issue is related to the application of laws to a certain extent. There may be differences in the negotiable instrument laws of different regions in some details. Clarifying the place of issue is conducive to determining the applicable legal provisions in case of disputes.

- Signature or seal of the drawer: The drawer needs to sign or seal on the instrument to confirm and promise the content of the instrument. This is an important basis for the drawer to assume liability for the instrument. Through the signature or seal, the drawer indicates its recognition of the matters recorded in the bill of exchange and is willing to bear the corresponding legal consequences. Without any of the above elements, the bill of exchange may be regarded as invalid. Therefore, when issuing and receiving a bill of exchange, it is necessary to carefully review these key contents.

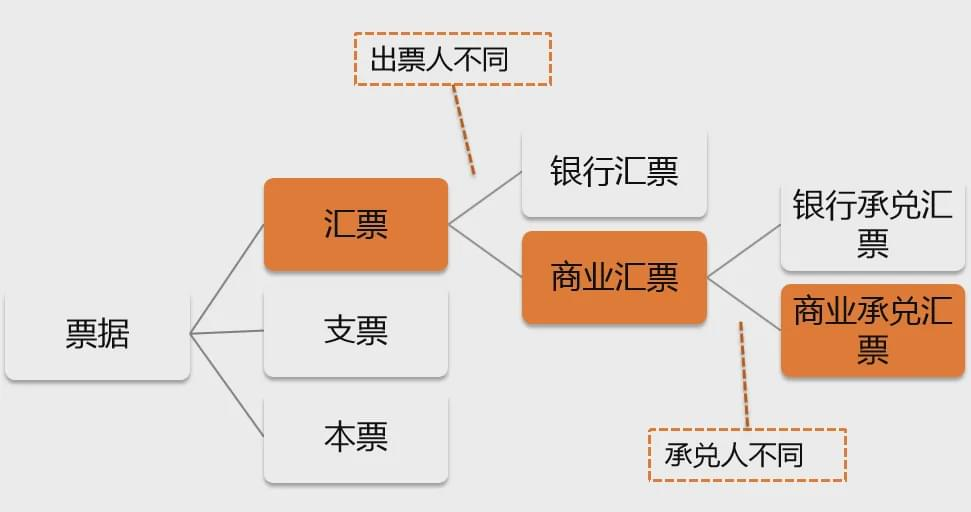

(1) Bank draft:

A bank draft is a bill of exchange issued and guaranteed by a bank. It is widely used in large – value international trade transactions. For example, a Chinese enterprise imports high – end equipment from Germany, involving a transaction amount of millions of euros.

The Chinese enterprise can apply to its opening bank to issue a bank draft to pay the payment. Bank drafts rely on the credit of the bank and have a very high credit rating, with safe and reliable payment. When a bank issues a draft, it will conduct a strict review of the applicant’s financial situation, etc., to ensure that there are sufficient funds to pay the amount of the draft. This makes the payee not have to worry about the credit risk of the drawee, greatly enhancing the security of the transaction.

(2) Commercial draft:

A commercial draft is a bill of exchange issued by an enterprise or an individual. Compared with bank drafts, its credit risk is relatively high because the payment of a commercial draft depends on the credit status of the issuing enterprise or individual.

However, commercial drafts are easy to operate and have a low cost, and are more common in domestic trade. For example, a small – scale clothing enterprise purchases fabrics from a fabric supplier.

Due to the relatively small transaction amount and a certain trust foundation established by the long – term cooperation between the two parties, the clothing enterprise can issue a commercial draft to pay the payment, simplifying the transaction process and reducing the costs such as handling fees that may be generated from issuing a bank draft.

(2)Time bill of exchange:

A time bill of exchange is a bill of exchange that is payable on a specific future date or after a certain period. It is often used in large – value transactions or occasions that require deferred payment, helping enterprises relieve financial pressure.

For example, a real estate development enterprise purchases a large amount of building materials from a building materials supplier. Due to the huge transaction amount, the development enterprise may be temporarily short of funds.

The two parties negotiate to adopt the time bill of exchange settlement method and agree to pay on a certain date after the construction project reaches a certain progress, giving the development enterprise enough time to prepare funds and at the same time protecting the legitimate rights and interests of the supplier.

(1)Clean bill:

A clean bill is a bill of exchange without any attached shipping documents. Its operation is simple and does not require complicated document transfer and review.

However, due to the lack of shipping documents and other proof documents of goods delivery, the risk is relatively high. In the capital lending or small – value trade between affiliated enterprises with good reputation, clean bills may be used.

For example, in the capital allocation between the head office and the branch, a clean bill can be used based on a high degree of trust.

(2)Documentary bill:

A documentary bill is a bill of exchange accompanied by shipping documents and is usually used in international trade. These shipping documents include bills of lading, invoices, packing lists, etc., which are important proofs of the ownership and delivery of goods.

For example, in international commodity trade, such as the trade of oil, iron ore, etc., the seller submits a documentary bill of exchange accompanied by shipping documents, ensuring that the goods have been shipped and delivered as agreed, and also protecting its own right to receive payment.

Because the buyer can only obtain the shipping documents and pick up the goods after paying the amount of the bill of exchange, effectively ensuring the security of the transaction.

(1)Bank acceptance bill:

A bank acceptance bill is a time bill of exchange accepted by a bank and has a high credit rating. Enterprises need to apply to the bank to issue such a bill of exchange and usually need to provide guarantees or deposits. In the transaction where a large – scale equipment manufacturing enterprise undertakes overseas orders, when the equipment manufacturing enterprise purchases parts from a parts supplier, it may issue a bank acceptance bill.

After the bank accepts it, it becomes the principal debtor of the bill of exchange. Even if the issuing enterprise has financial problems, the bank must pay according to the bill of exchange agreement, greatly enhancing the credit rating of the bill of exchange and making the supplier more willing to accept this settlement method.

(2)Commercial acceptance bill:

A commercial acceptance bill is a time bill of exchange accepted by an enterprise or an individual, with commercial credit as the credit basis. It is often used in supply chain financing to help enterprises solve short – term funding needs.

For example, in the clothing supply chain, as the core enterprise, the clothing brand issues commercial acceptance bills to its upstream fabric suppliers, accessory suppliers, etc.

The suppliers can apply for discount financing from financial institutions with the bill of exchange, obtain funds in advance, solve the problem of capital turnover, and at the same time strengthen the cooperation relationship between supply chain enterprises.

1. Credit guarantee:

Bank drafts and bank acceptance bills have high payment security due to the credit guarantee of the bank.

As financial institutions, banks have strong financial strength and strict risk management systems. Their credit endorsement makes the payment of the bill of exchange more reliable.

For the payee, holding such a bill of exchange is like holding the bank’s payment commitment, greatly reducing the collection risk. In international trade and large – value transactions, this credit guarantee is particularly crucial and promotes the smooth conclusion of transactions.

2. Payment flexibility:

Sight bills of exchange and time bills of exchange provide different payment term options to meet different transaction needs.

Sight bills of exchange are suitable for scenarios where funds need to be recovered urgently or for immediate transactions, ensuring the rapid arrival of funds; time bills of exchange give the drawee a certain amount of time to prepare funds, relieve financial pressure, and at the same time provide the payee with a transaction arrangement based on the expected future receipt of funds. Both parties can flexibly choose the appropriate type of bill of exchange according to their own financial situation and the actual situation of the transaction.

3. Financing function:

Commercial drafts and acceptance bills can be used for discount financing to relieve the financial pressure of enterprises.

When an enterprise holds a commercial draft or a bank acceptance bill but is in urgent need of funds, it can apply to a bank or other financial institutions for discounting the unexpired bill of exchange. The financial institution will deduct the interest from the discount date to the maturity date of the bill of exchange at a certain discount rate and pay the remaining amount to the enterprise.

For example, a small – and medium – sized enterprise holds a commercial acceptance bill that matures in three months but currently faces a shortage of funds for raw material procurement.

By discounting the bill of exchange with the bank, the enterprise can obtain funds in advance for procurement, solve the problem of capital turnover, and enhance the enterprise’s capital liquidity and operational capabilities.

1. Credit review:

When accepting a commercial bill of exchange, it is necessary to review the credit status of the drawer and the acceptor to reduce the default risk.

For the drawer, the enterprise credit report can be queried, its past business reputation, operating conditions, and industry reputation can be understood to evaluate its credit.

For the acceptor, if it is a commercial acceptance bill accepted by an enterprise, a comprehensive credit review of the accepting enterprise is also required; if it is a bank acceptance bill, although the bank credit is relatively high, it is also necessary to pay attention to the bank’s operating stability and reputation.

For example, in a procurement project with a new supplier, if the supplier proposes to settle with a commercial acceptance bill, the purchasing enterprise should carefully review the credit of the supplier and its acceptor to avoid losses caused by the inability to pay the bill of exchange when it matures due to poor credit of the other party.

2. Clear terms:

Ensure that the bill of exchange clearly states the payment date, amount, and drawee information to avoid disputes. The accurate specification of the payment date is related to the determination of the payment time.

If the date is ambiguous or incorrect, it may lead to payment delays or advances, causing disputes; the amount in words and figures must be consistent and accurate, which is the key basis for fund payment; the accurate indication of the drawee information clarifies the main body of payment liability.

In actual operation, any error or ambiguity in any of these terms may bring troubles to both trading parties. Therefore, when issuing and receiving a bill of exchange, these key terms should be carefully checked.

3. Compliance with laws:

Be familiar with and comply with local and international negotiable instrument law regulations to ensure the legal validity of the bill of exchange. The negotiable instrument laws of different countries and regions may have differences in the issuing, endorsement, acceptance, payment, and other links of the bill of exchange.

For example, in the regulations on endorsement transfer, some regions require that the endorsement must be continuous and in a standardized form, otherwise the endorsement is invalid.

When using a bill of exchange in international trade, enterprises must understand and follow the relevant national and international prevailing negotiable instrument laws and regulations to avoid the bill of exchange not being able to be used normally or legal disputes due to legal compliance issues.

4. Risk prevention:

For large – value transactions, it is recommended to use bank drafts or bank acceptance bills to ensure the safety of funds.

Large – value transactions involve a large amount of funds, and once a payment risk occurs, it will have a huge impact on the enterprise. Bank drafts and bank acceptance bills are guaranteed by bank credit and can effectively reduce risks.

For example, in a cross – border large – scale equipment procurement project involving tens of millions of US dollars in transaction amount, the purchasing party uses a bank acceptance bill to pay the payment, which can reassure the supplier to ship the goods and ensure the smooth progress of the transaction. At the same time, it also provides a certain degree of flexibility in the purchasing party’s own capital arrangement.

Conclusion

I hope the above information can help you better understand the types and uses of bills of exchange.

If you have any questions or need further communication, please feel free to leave a message in the comment section or contact me through the contact information. Thank you for reading, and I look forward to interacting with you!